Multi-Family Case Study

Insight Property Advisors Shows that Preparation and Research Go a Long Way

A client who invests in multi-family buildings with value-add opportunities such as outdated interiors, nonfunctional layouts, and missing amenities was seeking another investable property in Philadelphia.

Insight Property Advisors found a triplex through the Berkshire Hathaway HomeServices network prior to it hitting the market. Located in Society Hill, one of Philadelphia’s premier neighborhoods, the property had fantastic upside value with high rental demand due to the excellent area and nearby McCall elementary and middle schools. The property had dated finishes and unusual layouts that limited its rent roll; however, we leveraged our network of designers and contractors to create a layout with maximum usable spaces and modern finishings. To further increase cash flow, we recommended that the client install a washer and dryer in each unit to maximize the rent for each of the three units.

In preparing for negotiations, Insight Property Advisors surmised that the owner would be motivated to sell due to the fact that the property was vacant for months, forcing the owner to take monthly losses. Another issue we leveraged was the zoning and use permits. Although the zoning was correct, our team discovered the existing permit was for a single-family dwelling. Since this proved to be a significant barrier to any buyer’s plans for a fully rented multi-unit property, Insight Property Advisors landed a large price reduction for the discrepancy and went on to rectify it for the client at the city level, securing the correct use of a three-unit building for our client. We were also able to negotiate an under-market value price of $600,000.

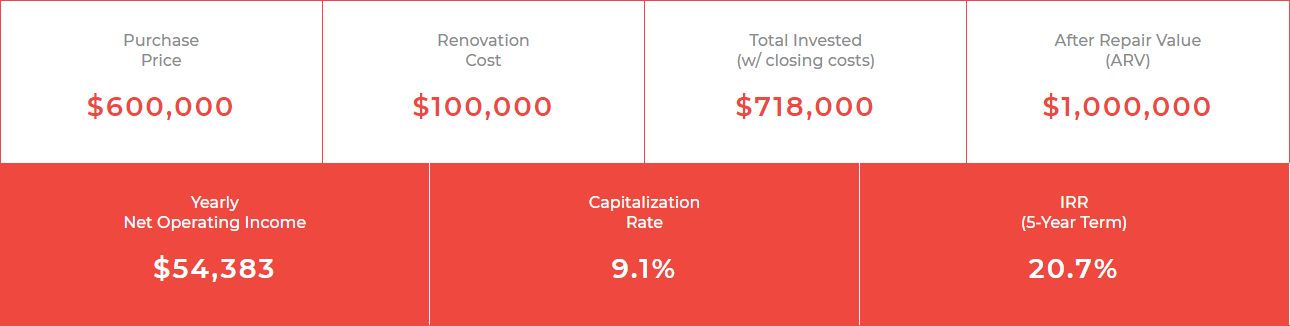

To create modern apartments with desirable layouts in this property, renovations totaled $100,000. After completion, the property appraised for $1,000,000, with the total rent roll for the property amounting to $6,000 per month with a gross income of $72,000. After all expenses, the property would generate $54,383 per year.

Here's How The Numbers Broke Down

Insight Property Advisors Key Takeaway

Prepare. Prepare. Prepare! Insight Property Advisors thoroughly researched this property’s potential and where the key points of leverage would be in the price negotiations. Because Insight Property Advisors has deep experience with multi-unit properties and the zoning and permitting environment, we were able to advise our client that the zoning and use permit discrepancy presented both a problem as well as an opportunity. Our network of contractors and contacts kept renovation costs low, and we found renters for each unit in the triplex immediately, so our client was able to quickly see a return on his investment once the project was completed.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.